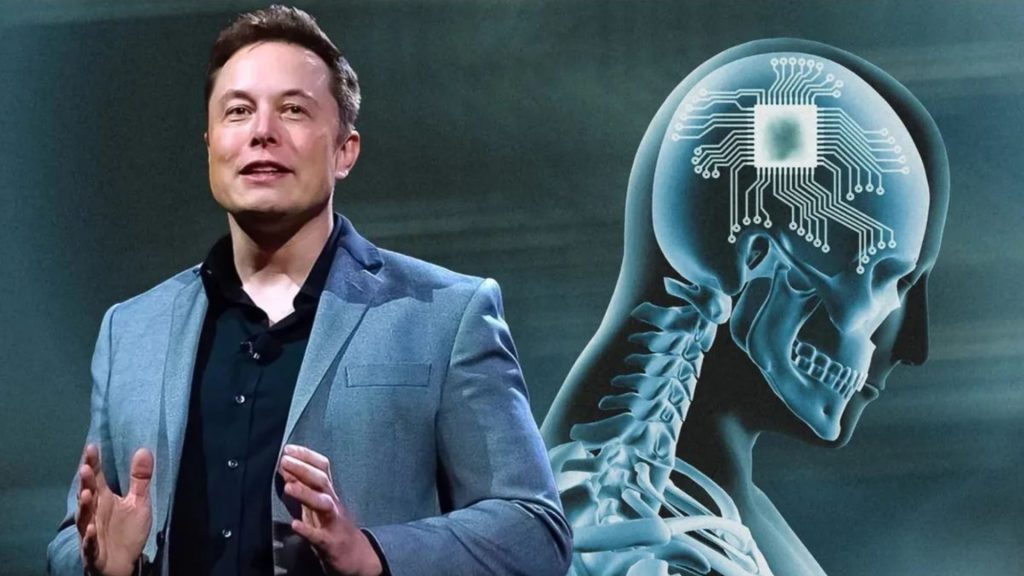

Elon Musk has relocated the incorporation of his ambitious brain-implant venture, Neuralink, from Delaware to Nevada. This decision comes on the heels of a legal confrontation in Delaware, where a judge nullified Musk’s $56 billion compensation package from Tesla, sparking Musk’s public criticism of the state’s corporate governance framework.

The incorporation change, documented in the Nevada secretary of state’s filings, marks a deepening rift with Delaware, a state renowned for its corporate-friendly laws. Musk’s critique of Delaware emerged strongly after the court’s decision, advocating for Nevada or Texas as preferable states for company incorporation due to their more shareholder-centric approaches.

Legal and Business Implications

Elon Musk’s choice to transfer Neuralink’s legal home to Nevada is not without its precedents or reasons. Nevada, known for its favorable stance towards companies with significant controlling shareholders, presents a strategic advantage for ventures like Neuralink. This move aligns with Musk’s broader business practices, as several of his other companies, including X and xAI, are also incorporated in Nevada.

Delaware, with its long-standing reputation as the go-to state for business incorporation due to its well-established corporate laws and legal precedents, continues to be the preferred choice for the majority of Fortune 500 companies. The state’s legal framework offers a level of predictability and stability that is hard to find elsewhere. However, Musk’s decision highlights a growing trend among companies looking for more autonomy from shareholder influence, considering Nevada’s legal environment as a suitable alternative.

Corporate Strategy and Shareholder Influence

Musk’s public statements following the court ruling in Delaware suggest a pivot towards states that offer greater deference to the decisions of company boards and controlling shareholders. This approach is indicative of Musk’s broader strategy to maintain a high degree of control over his companies, amidst ambitious growth targets and pioneering technology development.

Musk has even hinted at the possibility of Tesla, his flagship company, shifting its incorporation to Texas, pending shareholder approval. This gesture further underscores the importance Musk places on the geographical and legal context of his companies’ incorporations, as it relates to governance and operational freedom.

The Future of Delaware As A Spot For Companies

As corporate America watches Musk’s maneuverings from Delaware to Nevada, the implications for other companies considering incorporation or relocation are significant. While Delaware’s legal infrastructure remains a gold standard for corporate governance, the allure of states like Nevada, which offer a different set of advantages for companies and their controlling shareholders, is becoming more apparent.